First Home Buyers in Australia Can Now Buy Their First Home with Just a 5% Deposit and No LMI!

Helping Australians step into their first home – the faster and smarter way

Buying your first home could never be simpler. The Australian Government’s First Home Guarantee Scheme (FHGS) lets you secure your new home with as little as a 5% deposit. What’s more? You have to pay no Lenders Mortgage Insurance (LMI)!

As of 1 October 2025, the FHGS (previously known as the First Home Loan Deposit Scheme) has been expanded. It now includes more people, higher property caps, and new flexible options. In a nutshell, the FHGS has created more opportunities for Australians to own their first home sooner than they might think.

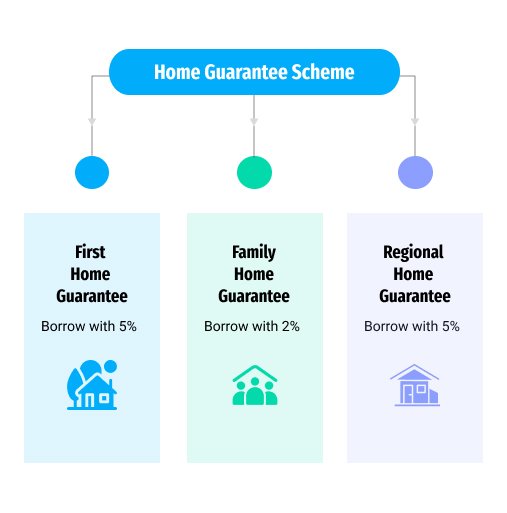

What’s the First Home Guarantee Scheme (FHGS)?

FHGS is part of the Federal Government’s Home Guarantee Scheme (HGS) and is managed by Housing Australia. The scheme helps eligible first-home buyers purchase their homes with just a 5% deposit. Here, the Government plays the crucial role of a guarantor for up to 15% of the loan. This also means that you won’t need to pay LMI, potentially helping you achieve a whopping $10,000–$25,000 savings. This, however, purely depends on your loan size and deposit size.

With only limited spots released each financial year for this scheme, your application through VOXFIN ensures you don’t miss out.

We’ll begin with assessing your eligibility, followed by matching you with the right lender, and then handling the entire process for you.

What Are the Key Benefits of the FHGS for You

| Benefit | What It Means for You |

|---|---|

| Buy with just 5% deposit | Get into your first home sooner without waiting years to save a 20% deposit. |

| No Lenders Mortgage Insurance (LMI) | Save thousands in upfront costs. |

| Government-backed guarantee | The Government guarantees up to 15% of your home loan. |

| Wider eligibility (2025 update) | Now open to singles, couples, friends, siblings, and family members. |

| Higher property caps | Reflecting rising prices across metro and regional Australia. |

| Available Australia-wide | Every state and territory has participating lenders. |

| VOXFIN’s 24-hour approval promise | Get assessed, approved, and ready to buy – faster than ever. |

Wider Eligibility (2025 update)

First Home Guarantee Scheme (FHGS) and First Homeowner Government Grants

| Grant/Scheme | Details | Value |

|---|---|---|

| First Home Guarantee Scheme and Family Home Guarantee Scheme |

|

Insurance savings depend on the value of your property. |

| First Home Super Saver Scheme |

|

Lower cash deposit required to buy. |

| First Home Owner Grant |

|

$10,000 |

| First Home Buyer Assistance Scheme |

|

Tax savings depend on the value of your property. |

| Maximum total support available ($) | Scheme eligibility may be subject to income caps, property value & other criteria. |

$10,000+ tax and insurance savings. |

| Grant/Scheme | Details | Value |

|---|---|---|

| First Home Guarantee and Family Home Guarantee Scheme |

|

Insurance savings depend on the value of your property. |

| First Home Super Saver Scheme |

|

Lower cash deposit required to buy. |

| Home Buyer Concession Scheme |

|

Capped at $35,238. |

| Maximum total support available ($) | Scheme eligibility may be subject to income caps, property value & other criteria. |

$35,238+ other tax and insurance savings depending on the value of your property. |

| Grant/Scheme | Details | Value |

|---|---|---|

| First Home Guarantee and Family Home Guarantee Scheme |

|

Insurance savings depend on the value of your property. |

| First Home Super Saver Scheme |

|

Lower cash deposit required to buy. |

| First Home Owner Grant |

|

$10,000 |

| Homebuyer Fund |

|

Insurance savings depend on property value and other factors. |

| Stamp duty savings |

|

Tax savings depend on the value of your property.

Further concessions and exemptions are available depending on other factors. |

| Maximum total support available ($) | Scheme eligibility may be subject to income caps, property value & other criteria. |

$10,000+ tax and insurance savings. |

| Grant/Scheme | Details | Value |

|---|---|---|

| First Home Guarantee and Family Home Guarantee Scheme |

|

Insurance savings depend on the value of your property. |

| First Home Super Saver Scheme |

|

Lower cash deposit required to buy. |

| First Home Owner Grant |

|

$15,000 |

| HomeStart |

|

$10,000(Must be paid back at completion of term). |

| Maximum total support available ($) | Scheme eligibility may be subject to income caps, property value & other criteria. |

$25,000+ insurance savings. |

| Grant/Scheme | Details | Value |

|---|---|---|

| First Home Guarantee and Family Home Guarantee Scheme |

|

Insurance savings depend on the value of your property. |

| First Home Super Saver Scheme |

|

Lower cash deposit required to buy. |

| First Home Owner Grant |

|

$10,000 |

| Stamp duty savings |

|

Tax savings depend on the value of your property. |

| Maximum total support available ($) | Scheme eligibility may be subject to income caps, property value & other criteria. |

$10,000+ tax and insurance savings. |

| Grant/Scheme | Details | Value |

|---|---|---|

| First Home Guarantee and Family Home Guarantee Scheme |

|

Insurance savings depend on the value of your property. |

| First Home Super Saver Scheme |

|

Lower cash deposit required to buy. |

| First Home Owner Grant |

|

$30,000 |

| Queensland housing finance loan |

|

Insurance savings depend on property value. |

| Stamp duty savings |

|

Tax savings depend on the value of your property. |

| Maximum total support available ($) | Scheme eligibility may be subject to income caps, property value & other criteria. |

$30,000+ tax and insurance savings. |

| Grant/Scheme | Details | Value |

|---|---|---|

| First Home Guarantee and Family Home Guarantee Scheme |

|

Insurance savings depend on the value of your property. |

| First Home Super Saver Scheme |

|

Lower cash deposit required to buy. |

| First Home Owner Grant |

|

$50,000 |

| Maximum total support available ($) | Scheme eligibility may be subject to income caps, property value & other criteria. |

$50,000+ insurance savings. |

| Grant/Scheme | Details | Value |

|---|---|---|

| First Home Guarantee and Family Home Guarantee Scheme |

|

Insurance savings depend on the value of your property. |

| First Home Super Saver Scheme |

|

Lower cash deposit required to buy. |

| Home Buyers Assistance

Reimburse some costs associated with the purchase of your first home including mortgage registration fees, solicitor and/or conveyancing fees, valuation fees, inspection fees, mortgage insurance premiums and lender fees. |

|

≤ $2,000 |

| Keystart |

|

Insurance savings depend on property value. |

| First Home Owner Grant |

|

$10,000 |

| Stamp Duty Exemptions |

|

Tax savings depend on the value of your property. |

| Total grants/discounts available ($) | Scheme eligibility may be subject to income caps, property value and other criteria. |

≤ $12,000+ tax and insurance savings. |

Assessment – Approval – Purchase

It’s VOXFIN’s 24-hour approval promise!

Am I Eligible for the First Home Guarantee Scheme (2025)?

Eligibility Criteria to Apply

- Be at least 18 years old

- Be an Australian citizen or PR

- Apply as an individual or joint applicant (a maximum of two people)

- Plan to live in the purchased first home (owner-occupied only)

- Have not owned property in Australia in the last 10 years

Eligible Property Types

Whether you’re buying a new one or building your own, the FHGS supports a variety of property types.

- An existing house, townhouse, or apartment

- A house-and-land package

- Vacant land, and a separate contract to build

- An off-the-plan apartment or townhouse

For approval and settlement, each of these property types comes with unique timing rules. As your mortgage specialists in Melbourne, we help you navigate the rules and regulations, ensuring you don’t miss any critical deadlines.

First Home Buyer Grants & Stamp Duty Concessions

by State at a Glance

Each state and territory has its own additional grants and stamp duty relief for first-home buyers.

Why Choose VOXFIN for Your First Home Loan?

We understand that buying your first home can get overwhelming. When you choose VOXFIN, you’re never alone. While we bring in genuine, expert, transparent guidance, we also promise lightning-fast approvals. We’re both practical and ethical. The goal is to make your homeownership journey seamless!

VOXFIN — Australia’s Trusted Mortgage Partner for First-Home Buyers

Here’s why VOXFIN has become a trusted name among first-home buyers –

- Direct access to 40+ trusted lenders

- No upfront fees

- 24-hour approval guarantee (on eligible applications)

- End-to-end prompt support – from pre-approval to settlement

- Expertise with complex cases, even when your case of previously declined

- Nationwide service coverage – Melbourne, Sydney, Brisbane, Perth, Adelaide, Canberra, Hobart & regional parts of Australia

Empowering Australians to achieve their first homeownership with local expertise and 100% integrity

Want to take the first step today?

With VOXFIN’s First Home Guarantee support, your dream of first homeownership in

Australia could be just a few weeks away!

Why choose us?

We understand the importance of earning your trust in the guidance provided by the mortgage experts at VOXFIN. We can assist you with all types of home loans as well as all other financial lending needs, such as refinancing home loans, car loans, commercial loans, and insurance.

Additionally, we can assist with organising financing to start or grow your business and fund your assets. Our services for finding the right home loan are free of charge to you. Once your loan is settled, the lender compensates us.

Expert first home buyer loan mortgage brokers at VOXFIN are here to assist you with all first home loans. We simplify the loan process and provide the right information and guidance so you can make sound investment decisions.

We assist Australians throughout the nation. We work with over 40+ lenders in Australia to bring you the best loan option with the lowest interest rate and the most appropriate home loan structure to grow your property portfolio

Australians have trusted us as expert home loan mortgage brokers for all types of their loans and mortgage needs such as first home buyer loans, refinancing home loans, agribusiness loans, business loan brokers, commercial loan brokers, car loan brokers, asset and equipment finance brokers, SMSF property loans, property development finance brokers, business car loan brokers, bad credit score lenders, medical professionals’ loans, personal loan brokers, and many more to help them find the suitable loans to finance their property dreams.

Get a Free Consultation

info@voxfin.com.au

03 70652000|0435 393 623

At VOXFIN, we are committed to being with you at every step in your home loan process. We keep your best interests ahead of everything by providing comprehensive solutions powered by our solid industry expertise and deep financial knowledge. This ensures you can confidently make an informed decision, knowing that you have our full support.

Our streamlined home loan borrowing process is designed to alleviate the stress of navigating the complexities of finding the best home loan solution. We’re here to secure the lowest interest rates on your owner-occupied home loan, making the process as smooth and convenient as possible for you.

What Our Customers Say

Latest Home Loan News and Tips

Expat Home Loans: Investing in Australian Property While Living Abroad

This Blog Is an Expert Guide for Australians Who Are Keen on Buying Property Across Australia...

‘Help to Buy’ Explained: A New Path to Homeownership in Australia

✔ Reduce the deposit required ✔ Reduce your home loan amount ✔ Reduce your monthly repayments...

10 Smart Ways to Prepare for Your First Home Loan in 2025-2026

Buying your first home is a dream come true. For most first-home buyers, the first step of this...